Volaris and Viva CEOs share how the formation of a new airline group will accelerate the expansion of low-cost air travel and strengthen connectivity in Mexico and abroad.

Más Vuelos, Menos Costo

The formation of this new airline group marks an opportunity to realize significant long-term growth for airline travel in Mexico, in line with the low-fare and point-to-point approach that has revolutionized the industry over the last two decades. The economies of scale and expanded distribution capacity will allow us to compete even more effectively in domestic and international markets by lowering fleet ownership costs, enabling us to offer ultra-low-cost fares to even more passengers.”

Enrique Beltranena

President and Chief Executive Officer, Volaris

Viva and Volaris will provide ultra-low-cost fares and more point-to-point travel to even more cities across Mexico and internationally. Both airlines share a similar low-cost DNA and mindset and have always believed in making travel more accessible and possible for everyone. Our passengers choose us for our point-to-point networks, seamless customer service, and low fares, so maintaining our ultra-low-cost strategy is essential for sustaining growth.”

Juan Carlos Zuazua

Chief Executive Officer, Viva

Building Broader, Better Low-Cost Travel

New Runway to Expand Affordable Air Travel

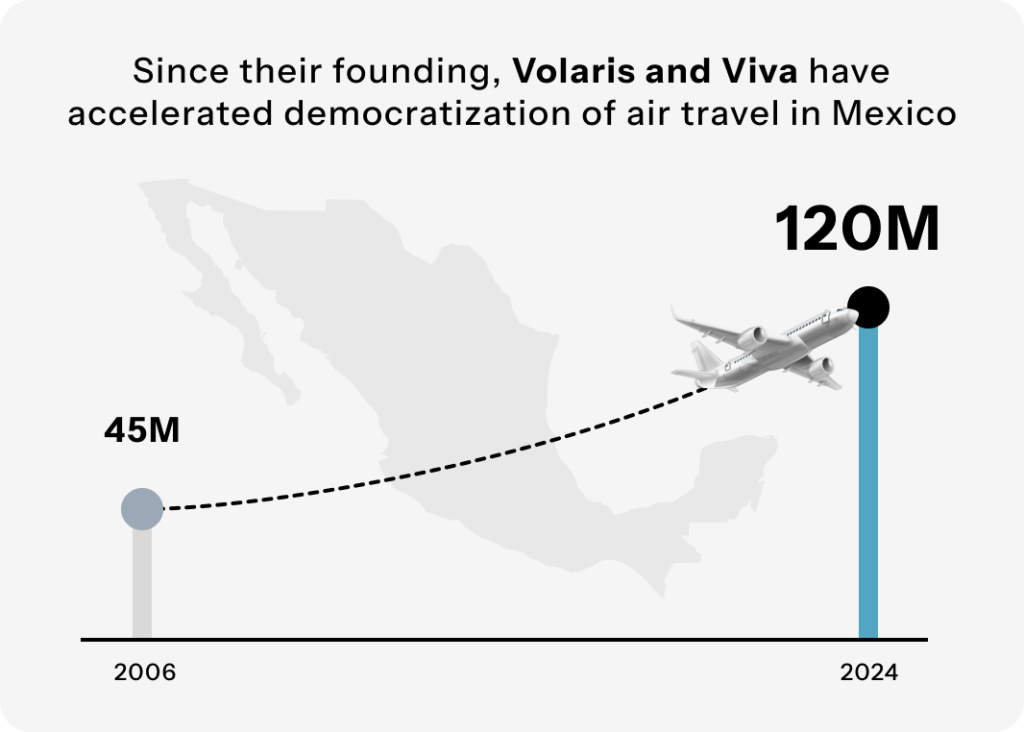

Well-connected networks, increased distribution capacity, and a more resilient platform position the carriers to sustainably expand their ultra-low-cost service to underpenetrated domestic regions and international sectors, increasing passenger choice and supporting the continued democratization of air travel for a broader set of customers across Mexico.

Stronger Foundation for Ultra-Low-Cost Carrier Model

The airline group structure, leveraging the compatibility of Viva’s and Volaris’s operations and economies of scale, will help drive cost-savings and a lower cost of capital for both carriers, enabling investment in continued disciplined passenger volume growth and supercharging ultra-low-cost air travel in Mexico.

Preservation of Passenger Choice and Operations

Volaris and Viva will continue to operate as separate carriers under a holding company structure, maintaining current operations, independent air operating certificates, and distinct brands, and providing passengers with the same options they have today. The airline group structure has proven successful in other geographies, including Europe and Latin America.

Source: AFAC

Positive Impact for Passengers and Other Stakeholders

Passengers, employees, and shareholders will benefit significantly from Viva and Volaris sustainably growing ultra-low-cost air travel. This exciting milestone will also benefit the broader Mexican labor market, tourism, and regional economies and cities across Mexico.

MEDIA AND IR CONTACT INFORMATION

For Media Inquiries

FTI Consulting

Jorge Padilla

Tanner Kaufman

Mike Gaudreau

AnuncioVivayVolaris

@fticonsulting.com

For Investor Inquiries

Volaris Investors

Liliana Juárez

Investor Relations Manager

[email protected]

Viva Investors

Marcelo González

Investor Relations Director

[email protected]